what is the property tax rate in ventura county

This is the total of state and county sales tax rates. Start Your Ventura County Property Research Here.

Second Installment Of 2020 21 Ventura County Secured Property Taxes Due Now 10 Penalty Plus 30 Cost Assessed After April 12 2021

Along with the countywide 072 tax rate homeowners in different cities and districts pay local rates.

. The median property tax on a 56870000 house is 597135 in the United States. What is the property tax rate in Ventura County. The Ventura County sales tax rate is 025.

This is the total of state and county sales tax rates. The minimum combined 2021 sales tax rate for Ventura County California is 725. What is the property tax rate in Oxnard CA.

The median property tax also known as real estate tax in Ventura County is 337200 per year based on a median home value of 56870000 and a median effective property tax rate of 059 of property value. The median property tax on a 56870000 house is 420838 in California. The median property tax on a 56870000 house is 335533 in Ventura County.

Ventura County has one of the highest median property taxes in the United States and is ranked 123rd of the 3143 counties in order of median property taxes. 7 rows Property Tax Rate. What are the taxes in Ventura County.

The Assessor does not prorate the assessments. What is the property tax rate in Ventura County California. Tax Rates and Info - Ventura County.

On January 1 each year lien date. The California sales tax rate is currently 6. Tax Rate Database - Ventura County.

Look Up Property Records. Sanders will oversee operations for more than 400 EMTs paramedics and. Ventura County collects on average 059 of a propertys assessed fair market value as property tax.

The average effective property tax rate in San Diego County is 073 significantly lower than the national average. The California state sales tax rate is currently 6. The California state sales tax rate is currently 6.

073 Overview of California Taxes Californias overall property taxes are below the national average. The bill for the coming tax year is then issued to the owner of record at that time and that individual is liable for the taxes even if the boat was sold soon after that date. This is the total of state and county sales tax rates.

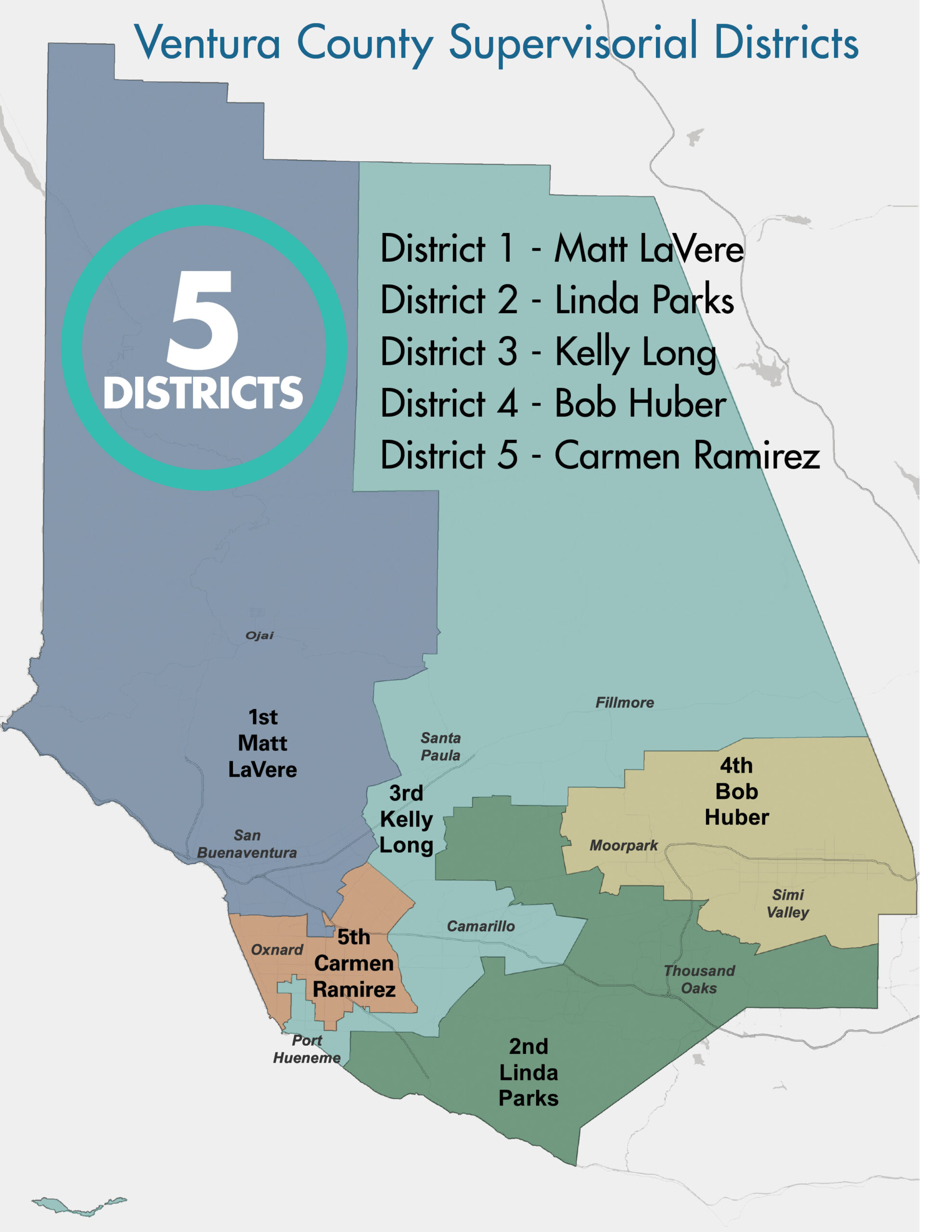

Thousand Oaks includes Newbury Park and Ventura area of Westlake Village. Thousand Oaks Newbury Park and Westlake. The Ventura County sales tax rate is 025.

The minimum combined 2020 sales tax rate for Ventura County California is 725. Californias overall property taxes are below the national average. The average effective property tax rate in California.

What is the property tax rate in California. Ad Need Property Records For Properties In Ventura County. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar.

073 County Median Home Value Average Effective Property Tax Rate Trinity County 284600 052 Tulare County 191200 078 Tuolumne County 278900 076 Ventura County 559700 073. Keeping this in consideration what is the tax rate in Ventura County. The median Los Angeles County homeowner pays 3938 annually in property taxes.

The median property tax in Ventura County California is 3372 per year for a home worth the median value of 568700. The median property tax in Ventura County California is 3372 per year for a home worth the median value of 568700. The County sales tax rate is 025.

The California state sales tax rate is currently 6. 8 hours agoAMR is the sole provider of ambulance services in Ventura County and operates subsidiaries including Gold Coast Ambulance. The average effective property tax rate in California is 077 compared to the national rate which sits at 108.

Liability for vessel property taxes attaches to its owner as of 1201 am. Ventura County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax collections. Ventura County collects on average 059 of a propertys assessed fair market value as property tax.

Ventura County collects on average 059 of a propertys assessed fair market value as property tax. Revenue Taxation Codes. The most straightforward way to calculate effective tax rate is to divide the income tax expenses by the earnings or income earned before taxesFor example if a company earned 100000 and paid 25000 in taxes the effective tax rate is equal to 25000 100000 or 025.

The property tax rate is 1 of the assessed value plus any voter approved bonds fees or special assessments. What is the property. 059 how do you figure out tax percentage.

The combined 2020 sales tax rate for Ventura County California is 725. What is the real estate tax in California. 073 County Median Home Value Average Effective Property Tax Rate Trinity County 284600 052 Tulare County 191200 078 Tuolumne County 278900 076 Ventura County 559700 073.

The Ventura County sales tax rate is 025. The Ventura County sales tax rate is 025.

Pay Property Taxes Online County Of Ventura Papergov

Pay Property Taxes Online County Of Ventura Papergov

Cash Buyers Playing Big Part In Real Estate Market Open House Open House Real Estate Real Estate Marketing

Ventura County Ca Property Tax Search And Records Propertyshark

County Seal Color Ventura County

Ventura County Ca Property Tax Search And Records Propertyshark

Ventura And Los Angeles County Property And Sales Tax Rates

The Safest And Most Dangerous Places In Ventura Ca Crime Maps And Statistics Crimegrade Org

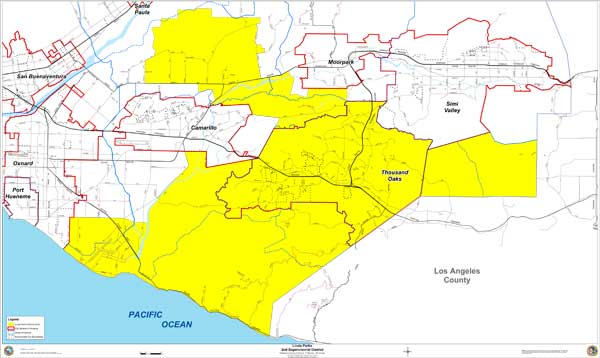

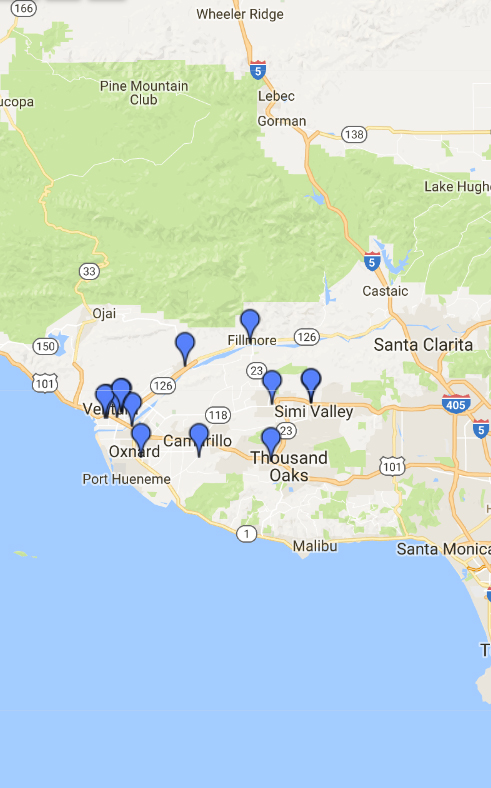

Interactive Maps Ventura County Public Works Agency

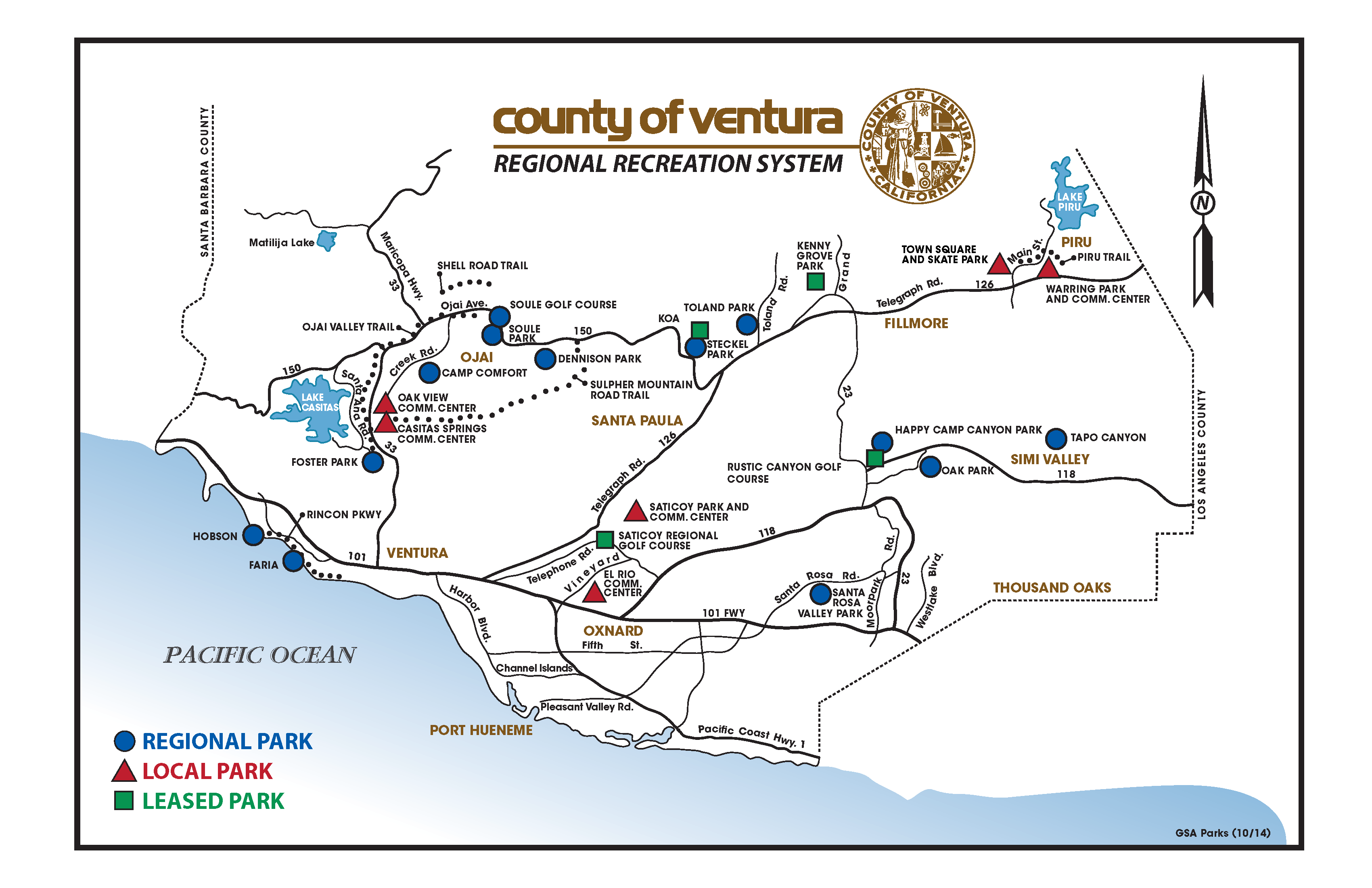

Parks System Map Ventura County

Homes Are More Affordable In 44 Out Of 50 States Tax Refund 50 States States